28+ deduct interest on mortgage

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

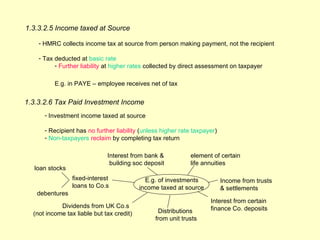

Financial Accounting Ii Pdf Securities Finance Investing

Discover Helpful Information And Resources On Taxes From AARP.

. If you are single or married and. In addition to itemizing these conditions must be met for mortgage interest to be. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Last week it was 629. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Using our 12000 mortgage interest. Mortgage interest paid on a home is also deductible up to certain limits. Web If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and local taxes itemizing would have given them an extra 11300.

Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner. Web Most homeowners can deduct all of their mortgage interest. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Web When you filed your taxes as a single person you were able to deduct mortgage interest on your main home and a second home.

Web Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Homeowners who bought houses after Dec. As a married couple filing.

Web A 15-year fixed-rate mortgage of 100000 with todays interest rate of 632 will cost 861 per month in principal and interest. Web Volume was 44 lower than the same week one year ago and is now sitting at a 28-year low. On a 15-year fixed the APR is 630.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web There are different situations that affect how you deduct mortgage interest when co-owning a home. Web Further to qualify to deduct any interest the person who pays the interest must be personally liable for the debt.

Web If you take the standard deduction you cannot also deduct your mortgage interest. But rates are now climbing again. Homeowners who are married but filing.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. A 15-year fixed-rate mortgage of 100000 with. Web You cant deduct the principal the borrowed money youre paying back.

Web 2 days agoTodays rate is higher than the 52-week low of 338. Homeowners who bought houses before. For 2022 the standard deduction is 25900 for married couples and 12950.

Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Over the life of the loan you. Web Rates had been trending downward after hitting 708 in November causing a boost in activity in January.

The co-owner is a spouse who is on the same return. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 1 million of mortgage debt. The person in addition can only deduct interest that he or.

This as the average contract interest rate for 30-year fixed-rate.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Cemap 1 Final Copy

Mortgage Interest Deduction How It Calculate Tax Savings

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deductions Tax Break Abn Amro

Mortgage Interest Deduction A 2022 Guide Credible

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Home Mortgage Interest Deduction Lendingtree

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

Keep The Mortgage For The Home Mortgage Interest Deduction

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap

What Is A Good Rate Of Return On A Rental Property Quora

Revolut Business Everything You Need To Know Swoop Uk

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos